Dear Reader,

When arguing with members of the lithium-denialist cult, it’s only a matter of time before one can expect the unsheathing of the reliable and ubiquitous "lithium does more harm to the environment than fossil fuels" argument.

And you have to admit the evidence can be compelling.

When looking at a collection of traditional lithium evaporation ponds, it’s hard not to grimace at the thought of all the nasty interactions taking place between the solution and the soil surrounding it.

But when looking at the big picture, this assault on the emotions rapidly breaks down into a web of fallacies, half-truths, and failures to comprehend.

In their present forms and at their present rates, lithium and cobalt mining combine to account for less than 3 million tons of annual carbon dioxide.

The combined effect of the global fossil fuel industry, on the other hand, is over 34 billion tons — more than 10,000 times the footprint.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

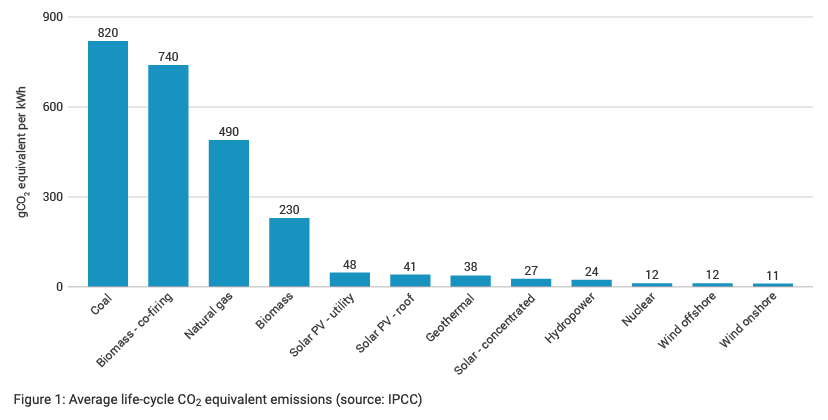

Even when you include all the overhead required to turn physical force into usable kilowatt hours — including the equipment necessary to make the conversion — the comparison between lithium-based batteries and fossil fuels in terms of lifetime effect on the carbon footprint is dramatic.

So there’s that, but even these small appeals to logic are insignificant compared with the bigger, more compelling argument.

What All the Talking Heads Never Get Right

You see, lithium is a storage medium and nothing else.

How you create the energy that goes into that medium is what ultimately decides whether a lithium battery is taking away from the carbon footprint or contributing to it.

You can charge batteries using electricity you generated burning oil, gas, or coal — another argument commonly wheeled out by the cult — but you can also charge them using renewables, nuclear, or any other method of making electrons get up and move en masse.

That makes batteries completely adaptable to the situation, the economy, and the available infrastructure.

With fossil fuels, the only way to harness the energy is through production and refinement of a finite resource, and the only way to convert the stored energy into something usable is combustion, which also leaves you some carbon dioxide and particulate pollutants as a parting gift.

Compared with lithium power, fossil fuels are hopelessly confined to a very narrow spectrum of use scenarios, not to mention suitable hardware to get the job done.

Ever hear of a gas-powered wristwatch? I haven't.

Batteries, on the other hand, provide the perfect method for powering personal devices of all sizes, as well as 100,000-ton cargo ships and everything in between.

So when lithium denialists bring up how every charging station has a generator backup that runs off diesel or how an endangered species of poison dart frog is now at risk thanks to evaporation ponds in Chile, don’t forget that renewables are expanding their market share while everything else is in decline. That's not to mention the fact that fossil fuels have been contaminating the ecosystem at thousands of times the rate for decades on end, with complete decarbonization a physical impossibility.

Anecdotes Versus Megatrends

Still, those of us who have embraced that electron-driven future cannot help but cringe at the thought of having to pick and choose what to kill to benefit the greater good.

We should be able to have it all: clean, potent power at no cost to the environment at all.

Right now, that vision of the future is coming closer and closer to reality.

For the last several weeks, I’ve been writing you about a company operating out of Calgary that’s perfected a method for converting oil and gas production operations to also harvest lithium.

The environmental impact is close to nothing, as all this company does is tap into the wastewater flow, filter the brine, and walk away with salable lithium.

But the potential it opens up for global lithium production is nothing short of transformative.

The benefits begin by eliminating some of the biggest time-wasters associated with traditional lithium production.

No more guesswork. No more searching. No more test drilling. No more geologists taking their time.

Saving the One Resource We Can Never Recycle: Time

The lithium has already been harvested through years of leeching.

But perhaps even more importantly, this process opens dozens and perhaps hundreds of previously inaccessible resources for development.

Where traditional lithium mining takes up to a decade to get salable product off the property, this extraction method only requires the installation of a processing facility; production can be up and running in a matter of weeks.

Putting this as plainly as I can, this technology, scaled out globally, could be the missing piece of the great post-carbon vision.

Now, for the profit-minded speculator, the news gets better.

This is a lithium-production pure play, meaning that this is the focus. This technology. This business model.

There are no other divisions or departments. This company does this one thing and this one thing only, and it’s still in the early stages.

How early? Shares are trading at under $0.50 apiece on both the U.S. and Canadian exchanges, with a market capitalization of just over US$20 million.

This Is a Speculator's "Holy Grail" Stock

The technology is proven and already getting scaled out. Commercial production at the company’s chief testing ground — a 671-square-mile oil and gas property in Northwestern Alberta — is expected to commence next summer.

Annual revenues from the initial production rates are expected to surpass the company’s current market capitalization in just the first year and possibly by several-fold.

I don’t think I need to tell you what that sort of performance can do to a stock.

In the mind of a real resource speculator, this one has all the earmarks of a monster in the making.

My readers have been getting the inside track on this game-changing lithium player since I started coverage over the summer.

Things are really starting to heat up right now, though, as we start to ramp into next year.

I don’t know if I’ve ever been this excited about an energy-related stock, but you should make up your mind for yourself.

Get the full story right here by viewing my video presentation.

It’s quick, it’s free, and we won’t even ask for your email address.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.